By Derek Archambault, Director of Marketing, FoodScience® Corporation

It was announced that COVID-19 was added to the dictionary in the fastest time ever – just 34 days. However, when December rolls around and we start doing end-of-year retrospectives, the word of the year should really be “unprecedented.”

We’ve heard that word so often, it starts to become a bit like background noise. It is mentioned in every TV ad and email from brands assuring that “we’re in this together.” But the word is used frequently because we are living through something completely remarkable and unique: we have never seen nations shut down economies and schools, scientists work so quickly and collaboratively to create a vaccine or such a massive shift in behaviors from so many people. We’ve also never seen a financial impact on such a scale since the Great Depression.

In many parts of the country, things are starting to “open back up” in various ways. So what comes next, and what does it mean for the pet industry and for veterinarians? What will be different for pet owners in a post-coronavirus world?

The two areas that will be the most impacted will be economic and consumer behavior. The first will likely have a bigger impact but felt in very different ways than the second.

ASSESSING THE ECONOMIC IMPACT

We are seeing record unemployment levels and with many businesses losing significant revenue or being forced to shut down. People will likely feel the impact of the virus in their wallets even if they’re lucky enough to avoid contracting it. However, this is different than other economic crises in that it wasn’t caused by an underlying systemic issue like the dot-com bubble bursting or the housing market collapse. Banks and companies were actually well capitalized and the economy was strong before the rug got pulled out from under it. If everything could immediately go back to how it was in January, it would be likely that the economy would indeed come “roaring back” as some people say. However, travel represents about 7.8% of the United States GDP and restaurants represent around 4%, so it will be hard to see true economic recovery until those get back to close to normal.

The good news is that overall, the pet industry is what is commonly referred to as a “recession proof” industry. However, that doesn’t mean that all parts of the industry react the same way to an economic downturn.

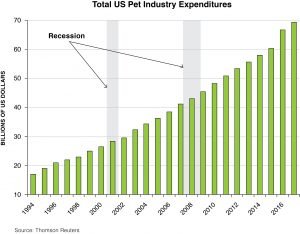

Let’s start with the historical perspective of how the overall pet industry has behaved over the years, including during past recessions:

Clearly the pet industry has shown remarkable resiliency during economic downturns. This is due to a shift in spending as consumers face different realities: when faced with financial challenges, they may not be as extravagant with their pet purchases, but various pet products become an “affordable luxury” – premium treats and toys for example – and in recent years pets themselves can act as a substitute for children while working to get on more financially stable ground.

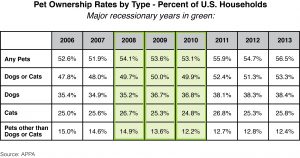

There are myriad reasons for the strength of the pet industry, but at the heart of it is the generational interest in it – children who grow up with pets are likely to want one themselves and ”empty nesters” often look to pets for companionship. Regardless of the economic climate, people love their pets and spend money on them. This is proven by research that shows steady pet ownership through recent recessionary years:

Pet Ownership rates by type: Percent of U.S. Households (major recessionary years in green):

This bodes well for the pet industry in general, but we start to see a difference when you look at services. While there was no noticeable dip for overall pet industry spending, services did have a noticeable dip during the “Great Recession” in the 2009-2010 period.

This historical downturn in services is driving research company Packaged Facts to predict a major downturn in the pet services sector, but a less severe and shorter downturn in the retail sector (all in billions):

This projection shows a significant downturn for the entire pet industry in 2020 compared to its original projection, and even against 2019 figures. This is the result of people simply not being able to participate in several key portions of the pet industry, especially “non-medical pet services.” If groomers and kennels aren’t open, then there is no revenue to be had. In addition, a good portion of pet services (boarding/kenneling, walking, etc.) is driven by people traveling and being at work. With travel virtually non-existent and many people working from home, the demand for these services just isn’t there, even if they are open for business.

According to these projections, veterinary services are set to return to 2019 levels in 2022 while non-medical pet services won’t get there until 2023.

An indicator of how consumers may respond to their financial hardships can be seen from the previous recession. During that time, according to Packaged Facts, usage rates for heartworm control medication for cats went from 22.5% in 2007 and all the way down to 16.6% in 2010, and then bounced back to 23.5% in 2011 as the economy started to recover. In addition, the percent of consumers choosing store brand dry dog food went from 6.9% in 2008 to 9.4% in 2011.

Of course, it is not unusual for consumers to look for value during economic downturns. However, they often also look for “affordable luxuries” and way to control what they can when faced with so much uncertainty. This is often called “the lipstick effect” because lipstick sales usually fare well during recessions as it is a way to splurge on yourself in a minor way. During the Great Recession, sales of premium wine and ice cream surged.

Likewise, having control over your own health can feel like something you can focus on. While there was a downturn in fine dining from 208-2011, purchases of organic and natural food products for at-home consumption increased substantially. Human supplements have also done well during recessions, in part since they provide a potentially lower-cost solution to health challenges than medicine or elective procedures, something that easily transfers to the pet industry.

Interestingly, pet medicine and supplement sales are projected to stay strong in the coming years, with pet medicine growing at a CAGR (Compounded Annual Growth Rate) of 8.3% between 2019 and 2023 and pet supplements growing at a CAGR of 5.0% during that same time.

However, keep in mind that these are only projections – different regions of the country are experiencing COVID-19 in different ways. Some will fare better than this and some will fare worse. In addition, there is the unknown factor of whether or not the virus returns in a more severe manner later in 2020.

While there are numerous variables to consider, the message here is clear: 2020 is likely to be a very unusual year for the pet industry, and if your business is heavily reliant on non-medical and optional pet services, the impact is likely to be more severe.

CHANGES IN CONSUMER BEHAVIOR

Predicting how people will behave is difficult enough during normal times. Trying to figure out what will happen when faced with something that has no precedent is near impossible. But just like measuring economic impact, we can look to some past events for clues.

The period after 9/11 offers an interesting insight in terms of actions and timing: people stopped flying and it took about three years for airlines to get back to pre-9/11 passenger levels (but grew non-stop since then until the pandemic hit), patriotism hit a new high point, and new security measures were found everywhere. Government agencies like TSA and Homeland Security were created and we started to have regular interactions with metal detectors, pat-downs, and bag inspections at not only airports, but concerts and sporting events as well.

Between the Oklahoma City bombing in 1995 and the 2001 terrorist attacks, “defensive architecture” features suddenly became commonplace. Before the early 2000’s, large stores and buildings never had bollards – those pylon-like structures – to prevent attackers from driving right into the building or people.

Society is also surprisingly resilient: one would think that seeing planes fly into large skyscrapers would scare people from working and living in tall buildings, or possibly even cities entirely. Instead, in the ten years after 9/11, more skyscrapers were built than the rest of history combined, and the fastest growing areas around the globe have been urban areas. However, those skyscrapers have had improvements built into them in the effort to avoid another 9/11 disaster.

So what does a post-pandemic world look like? There are three areas to think about: hygiene, personal contact and convenience.

Excellent hygiene is one that many consumers will be on the lookout for as long as there is the threat of the virus. This will likely play out across many industries in various ways. Health inspection grades for restaurants will become even more important, and the guidelines are likely to change. Consumers will want to know how airplanes, rental cars, hotels, checkout lanes, theater seats, public restrooms, etc. are cleaned, as well as how frequently. Cleaning supplies that are usually hiding under the counter may become a symbol of quality and safety.

Personal contact is one that that will feel the most awkward for us, and likely will for a while. There is some debate as to whether the handshake will disappear. No one knows for certain, but more than likely a lot of people will be uncomfortable for a long time with such intimate contact with people they aren’t overly familiar with – like their vets and vet techs who they see once or twice a year, but interact with dozens of people daily.

In addition, there are the other touchpoints along the way that impact with the hygiene challenge: door knobs, credit card devices and public restrooms for example. Figuring out ways of respecting people’s preference and tolerance for personal space and touching will be critical and likely to change depending on the long-term path of the virus.

Lastly there is the matter of convenience. What does this have to do with a global pandemic that is the epitome of inconvenience? To find the answer, look at how stores, brands and consumers are reacting to the limitations placed on their lives. Buy Online, Pickup in Store (“BOPIS” in marketing parlance) has become part of our everyday lives. BOPAC – Buy Online, Pickup at Curbside – has now emerged as a new regular shopping (and restaurant take-out) experience. And you’ve likely contributed to the wild shifts in shopping behavior – from what we buy to where we buy it.

However, the panic buying has settled down for the most part and with that “noise” out of the way, we start to see a fundamental truth: while behaviors absolutely shifted at the outset of the pandemic in very unusual ways, really what is happening is the continuation – and in some cases acceleration – of behaviors that were already in place.

People buying on the internet isn’t exactly new, especially in the pet segment, one of the fastest growing parts of online sales. The percent of consumers purchasing pet products online has gone from 7% in 2015 to 22% in 2019. This is likely to accelerate even further thanks to the current situation. The laggards that weren’t buying online have had their hands forced and the occasional online shopper has likely shifted more dollars there.

However, it isn’t just shopping and buying online that is a consideration: but also how services are delivered. Consumers already gravitated towards online reservations and record-keeping systems, and this is likely to become the expectation going forward as they look for ways to optimize their time out of the house.

Telemedicine has become a popular buzzword for both human and animal care in the past few months, and given the concern about hygiene and personal contact, it is likely to continue to be a popular option. In addition, it is convenient for the pet parent: it will be attractive to people if it means that they don’t need to take time off for an office visit and deal with the issues of transporting their pet, regardless of their own personal health concerns.

From scheduling appointments to obtaining medical records to performing the actual visit, people will expect the same level of convenience and ease that they get from online retailers like Amazon, Chewy, and Walmart. This shift in thinking is really about considering the value that you as a veterinarian professional and vet clinic provides isn’t from the office visit but rather from your expertise and knowledge. How do you make it as easy as possible for your clients?

ADJUSTING YOUR BUSINESS PRACTICES

I personally enjoy researching and discussing economic and behavior trends, but what does this practically mean for you and your practice? There are four key areas to consider:

First, start with your clients and consider what kind of impact they are experiencing from the current situation. If you practice in an area where tourism drives local employment, a lot of people may be financially challenged for a long time to come. If your clinic has been around for a while, how did it fare during the great recession or after 9/11? This will give you a sense for what is to come.

Second, what are the mix of services and products that you provide to your clientele? Can you consider offering something different that may appeal more to them during times of economic uncertainty?

Third, is to think about how to provide reassurance to your clients about the safety – and importance of – vet office visits. Share how you are cleaning and sanitizing and ensure you’re performing best practices and keeping up with the ever-changing guidance.

Fourth, it is critical to take a look at your digital experience landscape. Can you consider telemedicine (rules vary by state), or at least offer online scheduling and records? If you already do those things, are there new, better platforms to consider moving to? If you haven’t already signed up for pharmacy home delivery, now is the time to do so to avoid losing clients to other online outlets. Don’t forget about your social media accounts – many people now go to social media for the latest information from businesses rather than web sites.

Unprecedented times call for unique solutions and creative thinking – whether that is getting all of us on the other side of the pandemic or keeping your clinic going strong in the coming years.

Derek Archambault is the Director of Marketing for the pet business at FoodScience® Corporation, the parent company of VetriScience®. He has over 20 years’ experience in marketing and consumer behavior, leading brands during tumultuous times and through transformative change. His experience includes being on the leading edge of digital marketing and disrupting traditional categories with his time at Dean Foods and Keurig Green Mountain. He has spoken at numerous conferences and participated in a variety of industry and category roundtables over the years. He has been with FoodScience® Corporation since January 2016 and has been providing thought leadership regarding what’s potentially to come as a result of the current pandemic.

Let's Connect: